We read about it every day, how industry after industry is being disrupted by digital ventures. How incumbents' risk being overturned and therefore immediately need to step up digital innovation to fight the digital rebels. Equally, we are puzzled when we hear that some digital businesses are being sold for very high multiples despite operating in industries with low entry barriers, not monetising the customer base and failing to turn a profit.

Oleto Associates have studied more than 50 digital businesses, most of which were founded over the last 10-15 years. These businesses were founded as "pure play" digital businesses, using a digital platform as an integral part of their operations, some delivering physical products or services. We share a selection of our findings in this article.

We found that nine models represent the business models the players explicitly or implicitly use. While many of the digital businesses are valued very high, a large portion of the digital startups are unsound businesses with the current business model they use. Many hope to be rescued through, e.g., new investments, acquisitions or by later finding a better business model.

It is highly beneficial for both for startups, investors and incumbents to understand these business models and how to exploit them to their advantage.

The Value of a Digital Business

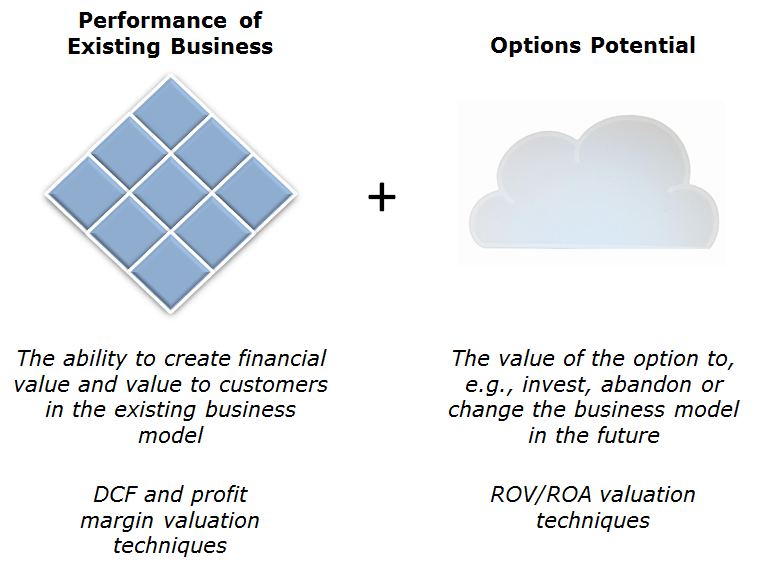

The principles for evaluating a digital business are in principle, or at least should be, the same as for a physical business, which is the net present value of the expected future discounted cash flow plus the options value potential (see exhibit 1). However, the level of certainty and the weight between these two value components play out completely differently for digital businesses making them much more difficult to evaluate.

Exhibit 1: The value components of a digital business

The performance of the existing business reflects the ability to create financial value and value to customers in the existing business model, which tells us something about the uniqueness of the products and services provided.

The options potential is the value of flexibility. It is the value of what you could potentially do with the business in the future, e.g., the option to leverage the customer base, the possibility to invest into new products/markets, the flexibility to enter into a combination with another business, or the freedom to change the business model.

Players with very high multiples are typically seen by the market as having large options potential (or being overpriced). We have focused our analysis of the value generated today from the existing business.

The Nine Digital Business Models

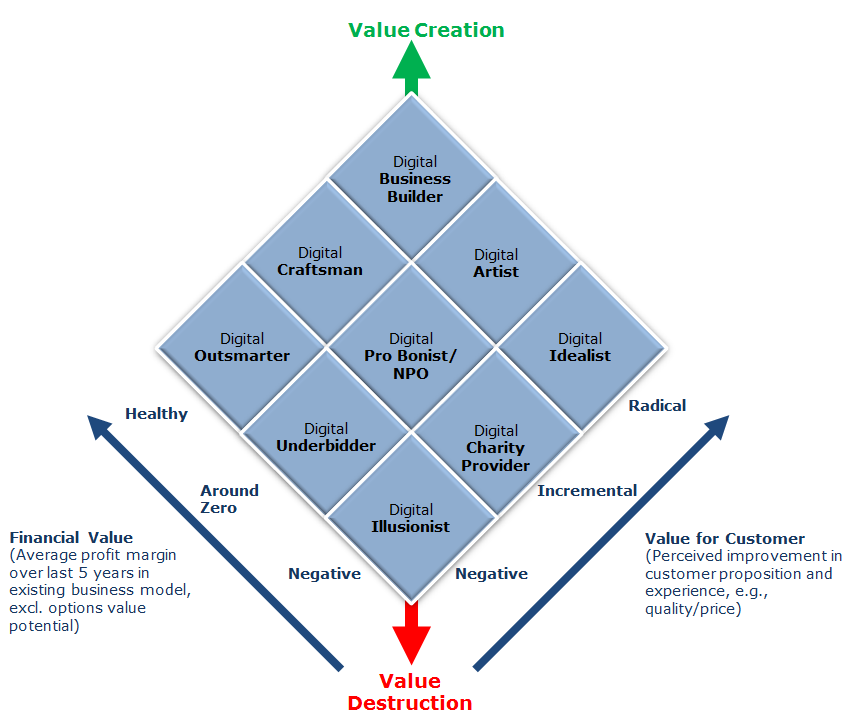

Our study of digital businesses reveals that the models followed can be classified into nine categories, according to two key aspects: The financial value created, e.g., indicated by average profit margin, and the perceived customer experience, see exhibit 2.

Exhibit 2: The nine digital business models

Digital Business Builder: The ambition of the Digital Business Builder is to revolutionise the world and make healthy profits at the same time. It is the model that most entrepreneurs will tell you they aspire to. This model creates good profit margins and gives the customers life changing experiences compared to if the company did not exist. Examples include the largest and most well-known online social networking service and the global online lodging marketplace. They both demonstrate profit ratios above 20% and a valuation with multiples over 100.

Digital Craftsman: The Digital Craftsman would like to create an in demand good, solid digital services and make a profit from day one. Although these businesses do create benefits for the customers, they tend to be less radical than the Digital Business Builder. In this category we find, e.g., an online monthly subscription service for beauty products, a large online clothing shop, a non-bank offering loans at lower rates than traditional lenders, and several online shops for electronics and online take away food.

Digital Artist: The Digital Artist wants to change the world while just making a living. Companies following this model deliver exceptional customer experiences and have significant revenues, but just enough to make the business break even. Examples include a social fitness tracking service, a co-development collaboration site, a travel metasearch engine and a global business oriented social networking service. All these companies have had profit margins around -1% to +1% for several years despite gaining increasing scale.

Digital Idealist: The Digital Idealist also wants to change the world though digital innovations but needs a substantial amount of cash while doing it. They are economically betting on the future rather than today. Naturally, most of the companies in this category hope to either change business model or become acquired by a larger player. Examples include an online concierge service, an artificial intelligence music composer, several online supermarkets, an online wine community, an international taxi network, an online everything store in India, a commercial music streaming service, a service for short online messages and an online human intelligence service.

Digital Pro Bonist/NPO: The Digital Pro Bonist is making a difference but is accepting a profit margin close to zero. Many of the online stores we studied are finding themselves in this category as they struggle with gaining volume to make a decent profit. Examples include several online fashion retailers and some “real” non-profit organisations, e.g., an online service that allows users to lend money via the website to people with low-income.

Digital Charity Provider: The Digital Charity Provider provides customers with value added experiences, but they make a loss year by year and thus are highly dependent on a constant range of sponsors to feed their existence. Examples include a company that delivers personal grooming packages though online subscriptions, a video messaging application, an online ordering service for home-cooked meals, and some locally focused online fashion retailers. All have profit ratios less than -15%, sometimes even worse.

Digital Outsmarter: The Digital Outsmarter manages to make nice profits without doing much good for the customer. One example is an online appliances store charging almost the same price as the physical stores, but delivering a low-quality return-goods flow or customer service. Another example is a global everything store hiding international toll and VATs prices, so products end up being more expensive than in the local markets.

Digital Underbidder: The Digital Underbidder creates inferior digital products and customer experiences, but also suffers from it making it hard to make a profit. They underbid in price or quality or both. An example is a company offering cheap streaming TV content without the expected quality and stability and then increasing prices once customers are captured.

Digital Illusionist: The Digital Illusionist manages to disappoint both from a financial perspective and customer value perspective. Examples include a private social neighbour network failing to provide relevant services, an online bike shop selling premium brand bikes so cheaply that they cannot deliver the bikes and go under, or a loss making online payment service with poor usability.

The Implications

All in all, we believe only three of the models are sound and sustainable: The Digital Business Builder, Digital Craftsman and the Digital Artist, possibly the Digital Pro Bonist, if the shareholders do not expect profits. Most companies in other models cannot stay there for too long. They need to change and the market seems to expect many to be able to successfully do so, hence the high options value potential/valuations.

So what does this mean for startups, investors and incumbents?

Well, startups/entrepreneurs probably do not think much about it. They would like to be Digital Business Builders from day one but most of them merely aim to do something good for the customer and then hope for discovery by the market, and of course, the investors. Our advice to them is to think about the business model journey. For example, a startup might go for the model of the Digital Idealist for 5 years and then bet on being taken over, enabling them to cash in, i.e., knowing that their business model only makes sense in a larger setup. Another strategy could be to aim for becoming a Digital Craftsman or Digital Business Builder quickly and then strike for dominance in the market as a standalone business.

Angel investors, venture capitalists and other investors should take these business models very seriously. They should be clear about how they expect the business model to change over time. This will help them find out when the right time to sell their stock is, or to help the company change to a new model at the right moment.

Incumbents should use this thinking to identify which disruptors are just smoke and mirrors, which ones are real threats, and which ones could be acquisition targets. Many startup companies are in distress since their models only make sense in a larger setups or do not make sense at all. We expect the number of acquisitions to pick up as incumbents start to fully exploit this.

About the authors: This article was written by a team of consultants from Oleto Associates, a strategy consulting firm based in Denmark. For more information please visit www.oleto.com.

February 2016